News

EU TAX: List of non-cooperative jurisdictions published

World's longest pipeline MoU signed

Saudi Aramco Expresses Interest to Do Business in Cyprus EEZ

As reported in Gold News.

Cyprus ready for all outcomes as drilling programme commences

Cyprus 64th among 137 countries in competitiveness

World Economic Forum, known as 'Davos Forum' marked the increase of 19 places in Cyprus and ranks 64th among 137 Countries in comparative table of Economies.

The press release of the European University, show that Cyprus ranks 64th regarding the degree of the competitiveness of economy. Compared with other EU member states, 24 countries rank higher than Cyprus. The ranking is decided based on the financial statistical database of each country, as well as interviews with representatives of businesses and organizations, the Cyprus News Agency reports.

The partners of the Forum in Cyprus, which took part in the study, are the Bank of Cyprus and the European University of Cyprus.

The top ten in the Global Competitiveness Report of the World Economic Forum remain the same as previous time. Switzerland is in the first place, followed by the USA, overtaking on third place by Singapore. The Netherlands, Germany, Hong Kong, Sweden, Great Britain, Japan, and Finland complete the top ten.

Alexandrou Corporate Services LTD

Alexandrou Corporate ServicesLTD is one of the most competitive and experienced corporate service in Cyprus based in Limassol.

Our Company provides

- Incorporation companies in Cyprus

- Asset Management

- Obtaining all relevant documents i.e. Certificate of incorporation, Certificate of directors and secretary, Certificate of registered office address, Memorandum and Articles of Association

- Opening, administrating and maintaining corporate and/or personal accounts in Cyprus

- Advising and registering companies for VAT in Cyprus, preparing all the necessary documents and submitting VAT reports to the authorities

- Carrying out all the communication between your company and third parties (Governmental authorities, Tax authorities, Banks)

- Conducting any form of communication required with other legal entities in Cyprus

- Consulting on general tax planning including tax structures and optimization of tax liabilities

Our Company has a vast experience in local and International market, thus providing you with the utmost efficient, knowledgeable and professional service possible, also we are extensively involved in finance, real estate investments as well as investments in trading and energy industries.

Our professional staff will accommodate your every need to suit your client's or company's requirements and make sure you company is presented in the best possible way.

Cyprus is EU Leader in CBI Index

Cyprus ranked highly with a score of nine in freedom of movement, just behind Austria and Malta, which both received top marks. A Cypriot passport allows for visa-free travel without restrictions to over 160 countries worldwide. Freedom of movement is of paramount importance for individuals when selecting a second citizenship, hence Cyprus's high score.

Cyprus also scored eight for standard of living, with Austria and Malta topping the rankings.

The Cyprus CBI programme was first introduced in 2002 at a premium investment of €15 million. The existing scheme became more competitive in 2013, and even more so following the Council of Ministers' September 2016 revisions, under which the minimum outlay was further reduced to a total of €2 million for the residential real estate investment option or €2.5 million for a combination of investments including real estate (both options include an investment of €500,000 in a residential property, which is to be held indefinitely).

Cyprus was ranked as having the fastest route to citizenship in the European Union with a score of eight. Cyprus also scored a respectable seven for ease of processing and clear procedures for citizenship applications and no additional language or health requirements. It scored six for due diligence, with Dominica and St Kitts & Nevis and Malta leading with 10 for their data collection and due diligence features.

In its recent study of citizenship by investment (CBI) programmes, the Financial Times' Professional Wealth Management ranked Cyprus ahead of other EU countries for its highly attractive travel and residency requirements.

Cyprus was ranked 67th overall. The rankings were based on the aggregate of seven measurable factors, scored on a scale of one to 10, with 10 being the highest.

The factors were:

- freedom of movement

- standard of living

- minimum investment outlay

- mandatory residency or travel requirements

- citizenship timeline

- ease of process

- due diligence

Source: http://www.goldnews.com.cy

An important step in liberalising the electricity market

The Cabinet approved a plan to support renewable energy sources (RES), In-Cyprus reports. The plan involves supporting the introduction of 212 Mega Watt of renewable energy source-produced electricity into the competitive market.

Currently 10% of energy supplies come from RES in Cyprus while the government has set a target of 13% by 2020.

Energy Minister of Cyprus, Giorgos Lakkotrypis, noted that the government is attempting to create a framework in order to introduce RES as quickly as possible while pointing out to the success of the photo-voltaic program which has attracted over 10,000 households over the last four years.

''We hope to improve our energy storage technology which will subsequently reduce costs'' said Mr. Lakkotrypis.

Taxes in Cyprus

When opening a company in Cyprus all investors must pay special attention to taxation regulations.

Income Tax

In Cyprus both individuals and companies are liable to income tax according to the Income Tax Law No. 118 issued in 2002. The income tax in Cyprus is paid for trade income, salaried services, pensions, interest, dividends, royalties and other incomes.

A person is considered a resident if he or she is present in Cyprus for a period time exceeding 183 days, therefore will be subject to the income tax from sources within Cyprus.

The Cypriot taxable income varies from 0% to 35% depending on the income.

For pensions earned for services rendered abroad the income tax is set at 5%.

Corporate Tax

The corporate tax in Cyprus for all business organizations is 12.5%

The corporate taxation in Cyprus is applied on all resident companies on their income derived from all sources from inside the country and from abroad.

In Cyprus, the VAT (value-added taxation) is applied on any service or product, as well as other types of transactions.

The corporate tax in Cyprus for all business organizations is 12.5%

VAT

The corporate taxation in Cyprus is applied on all resident companies on their income derived from all sources from inside the country and from abroad.

A standard rate of 19%: is applied to product and service supplies which are not subject to the zero VAT rate, the reduced rate or are not exempt

The first reduced rate of 9%: it applies to:

- Catering / restaurant services

- Accommodation in tourist establishments

- Passenger transportation inside the country

- Travel of passengers in inland waters

The second reduced rate of 5%: applies to:

- The foodstuff supplies

- The supply of beverages, except for alcoholic drinks

- Certain pharmaceutical product and vaccines supplies

- Animal supply for the food preparation

- Newspapers / magazines

- Other types of services and products

The zero rate (0%): is applied to:

- The product exports

- Modification, supply, repair, chartering, maintenance and employment of sea vessels, in certain conditions

- Modification, supply, repair, chartering, maintenance and employment of aircraft's, in certain terms

- Gold supplies to the Central Bank of Cyprus, and others

Set Up a Business in Cyprus

Opening a company is an easy thing to do in Cyprus. The Cyprus' Government is helping the foreign investors in its attempt to attract foreign capital especially by using low tax system and red tape.

The registration procedure does not take longer than 2 weeks and the UBO (Ultimate Beneficial Ownership) decided which one of the types of business regulated by the Company Law:

- Limited liability companies

- Public limited companies or company limited by guarantee or general and limited partnerships

Setting up of a company in Cyprus must begin with choosing a unique name that can be checked at the Registrar of Companies.

The memorandum of association, notarized and elaborated by a lawyer must be deposit, along with the specific documents at the Companies Section of the Department of Registrar of Companies and Official Receiver.

After registration, the Ministry of tax must provide a unique tax number and a VAT. The last step is registering at the Ministry of Labor for Social Contribution.

Cyprus has many advantages to offer for the investors, especially in the transportation areas. For example, the profits from the operations of the Cypriot vessels are not taxable. Also, the dividends of the companies that own ship are exempt from tax. It is located at the crossroads of three continents. Joining EU in 2004 bring major advantages to the foreign investors, such as allowing the foreign ownership of a company, increasing demand for property.

Also, double tax treaties were signed with more than 40 countries, in order to avoid the double taxation of the incomes of the foreign companies.

Cyprus has an excellent infrastructure, with 2 international airports, 2 shipping ports (Limassol and Larnaca) and a modern road network. This facilitates the export and import of the goods.

International companies and banks are operating in Cyprus attracted by the small costs, economic freedom and the well trained local companies, ready to counsel if necessary.

The hot weather, the culture and the Mediterranean cuisine are attracting tourist all year long.

Shell to Mull Buying Israeli, Cyprus Gas for Egypt Plant

Royal Dutch Shell Plc is seeking creative solutions to bring gas from Israel and Cyprus to market, a step that could help turn the Mediterranean region into a major gas-producing hub.

.jpg)

Shell is in talks to buy natural gas from Israel's Leviathan field, combine it with output from Cyprus's Aphrodite field, in which it owns a 35 percent stake, and pump it to a liquefied natural gas plant in Egypt, according to people with knowledge of the matter. Talks are at an early stage and some of Aphrodite's gas could be sold locally, said the people, who asked not to be named because the discussions are private.

Combining output from the fields, which share some major investors, could potentially improve the economics of the projects. Leviathan's partners, led by Noble Energy Inc. and Delek Drilling LP, are looking at various shipment options as they face an estimated development cost of $3.75 billion.The partners would have to seek further funds to increase the field's capacity if they do the deal with Shell, one of the people said.

Israeli and Cypriot gas finds, together with the giant Zohr field off Egypt and reservoirs off Lebanon, could create a center of gas production right on Europe's doorstep. While that has given a handful of nations access to vast resources, they're still trying to figure out the best way to use the fuel in a region fraught with political enmity.

Source: www.bloomberg.com

Larnaca International Airport, A Top European Airport

Larnaca International Airport continued to be the first among all the international airports of the European Union member between the group of airports with 5 to 10 million passengers per year and had achieved the biggest increase in passenger traffic.

According to ACI Europe, in the first half of the 2017, International Airport of Larnaca managed to maintain its third place on the passenger traffic increase chart since last March, among all international airports in Europe, in the category of 5 to 10 million passengers per year.

Larnaca Airport ranked third, with an increase of 22.7 percent or 571,926 additional passengers, preceded by Keflavik International Airport (Iceland), with 39.7 percent and Kiev International Airport (Ukraine) which occupies the second place with an increase in passenger traffic of 29.4 percent.

The Senior Marketing and Communications Manager of Hermes Airports said that ''the maintenance of Larnaca Airport on the ACI ranking alongside Europe's top airports confirms once more our successful course and the steady increase in passenger traffic.''

Cyprus the Future Business House

When it comes to investing, nothing will pay off more than the timing.

Do the necessary research, study and analysis and make investment decision to start.

Cyprus is the crossroads of Europe, Asia and Africa and is close to the busy shipping and air routes linking Europe with the Arab world, China and the Far East, representing a strategic hub for business activities in the region. Cyprus has a goal after the drilling and financial exploitation of the natural gas in Cyprus which will increase the per capital income by the next years.

Cyprus offers one of the most attractive tax systems in Europe.

The country provides an effective and transparent tax regime that is fully compliant with the EU laws and regulations.

- Corporate tax: 12.5%

- Tax on Dividends: 0%

- Capital Gains Tax: 0%

- Income Tax: First €19, 500 of income is tax free

Non-EU residents have the opportunity to acquire a Cyprus (EU) Citizenship & Permanent Residence through investment.

Cyprus is one of the few countries in Europe to promote residency and citizenship and residency.

The Cypriot government seeks to give all the benefits the country has to offer to professional people with families to take up residency in Cyprus for significant investments and acquire a Cyprus EU Passport which will enable the holder free access to live and work anywhere within the EU.

Cyprus has developed into an international business center that offers services and rewarding business opportunities for the diverse needs of international investors. Also, is the largest Foreign Direct Investment country into Russia. It is also becoming China's preferred business and investments gateway to Europe as well as Africa and the Middle East.

Tourist Arrivals Expected To Reach 3.5 Million in 2017

Million of tourists continue arrive in Cyprus in 2017 from Russia and the UK, while the total number of visitors from abroad is expected to reach 3.5 million in the coming months.

Moody's Upgrade Cyprus' Economy to Ba3

Moody`s

rating agency has upgraded government bond ratings of Cyprus by one notch, to

Ba3 from B1. Moody's maintained a positive outlook and said the short-term

ratings have been affirmed, at Not Prime (NP) and (P)NP.

Cyprus

Government Spokesman Nicos Christodoulides said that the upgrade of Cyprus by

Moody`s, "is another step in restoring confidence in our economy and

another confirmation that we are now on a path that creates a positive

outlook."

The

fact that Moody's maintained the prospects of the Cypriot economy on a positive

outlook means that it will probably proceed with a new credit rating upgrade in

the next assessment of Cyprus in November.

Cyprus

is now three upgrades away from the investment grade of Moody's.

According

to the rating agency, the key drivers for the rating action are improvements in

economic resilience that have occurred over the past two years and that seem

likely to continue in the medium term, as well as the consistent fiscal outperformance

and continuing favorable fiscal outlook for Cyprus.

Source: www.goldnews.com.cy

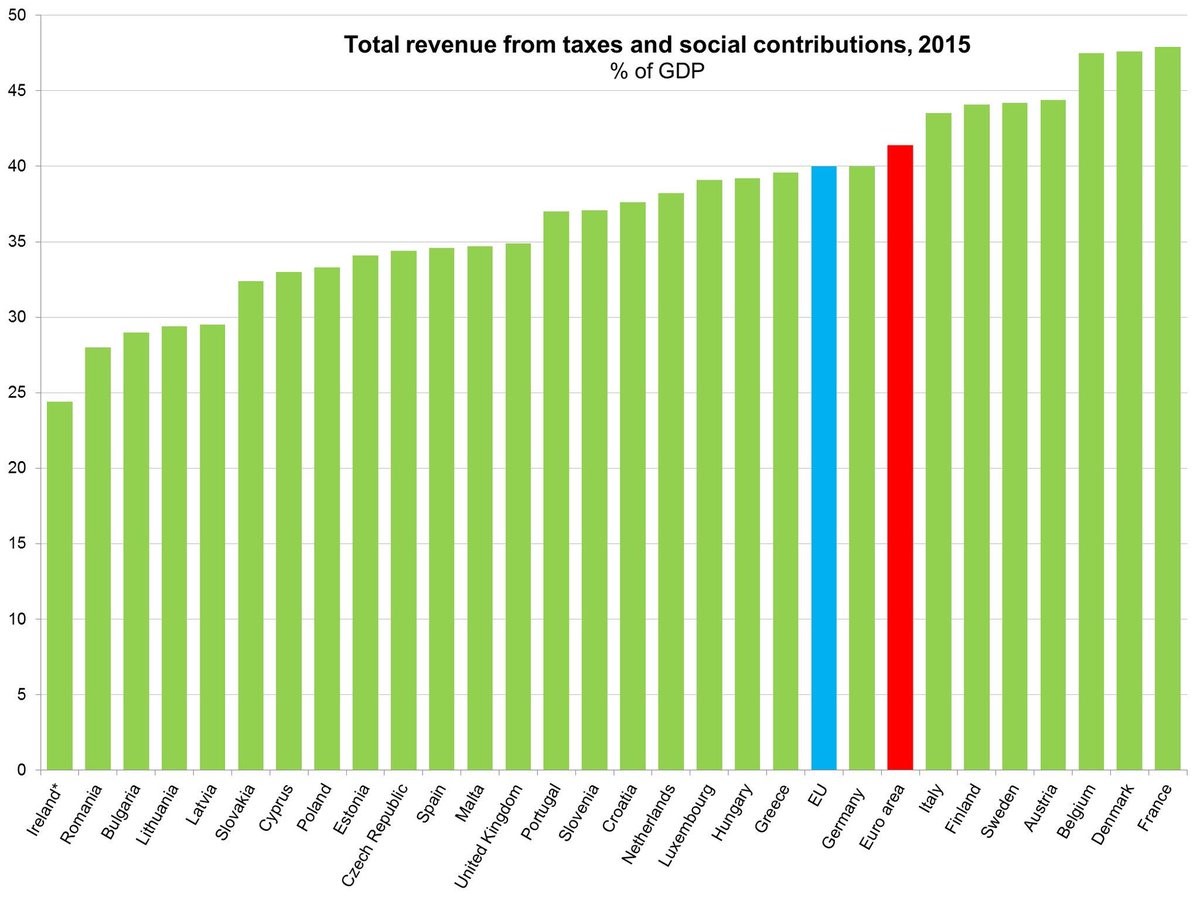

Cyprus has the most favorable tax system for corporate and individuals in EU

Cyprus has the lowest rates in the EU, at 12.5% corporate tax, together with Ireland (12.5%) and excluding the Isle of Man, Jersey and Guernsey, which although have a nil rate for non-financial services firms (and 10% for financial services firms) are not in the EU.

- Tax on Dividends: 0%

- Capital Gains Tax: 0%

- Income Tax: First €19, 500 of income is tax free

It is important to highlight that Cyprus is not an offshore tax haven. The Cypriot tax regime and tax legislation is in full conformity with both European Union Laws and Directives and with the Organisation for Economic Cooperation and Development (OECD).

Testament to this is also the extensive network of Cyprus double taxation treaties, working closely with other nations to benefit their private sector, encourage investment, growth and progress, whilst ultimately also benefiting the company's home country.

In fact, Cyprus has not only fully adopted all EU Directives, it has even gone further by not imposing minimum holding period, percentage holding and any other restrictions used by most Member States.

Indeed, tax planning advantages in Cyprus reach far beyond saving tax (money). It is a complete business strategy for investment (especially to Europe, Middle East and Africa), as well as a global solution for financial efficiency. These benefits are for large corporate companies, small and medium size enterprises, as well as individuals.

Reasons to invest in Cyprus

Companies looking for an investment opportunity must take into consideration that Cyprus as it is an EU member state since 2004 thus providing investors with access to the EU market.

Among the most important advantages for doing business in Cyprus are the flexible taxation system, the banking system and the insurance networks, all of these at very competitive costs. Foreign entities wanting to invest in Cyprus will benefit from low start-up and operations costs.

Our Country also provides a good environment for people wanting to obtain residency in Cyprus as they can purchase real estate properties at very good prices and the quality of life is very high.

Strategic Location

Cyprus has ideal geographical position at the crossroads of three continents - Europe, Africa and Asia and it plays a key stabilising role in the region of the Eastern Mediterranean.

The island is an exceptional investment gateway to the European Union, as well as a great portal for investment outside the EU, particularly into the Middle East, India and China.

Tax System

Cyprus offers an attractive tax system, fully compliant with EU, OECD and international laws and regulations.

Taxable profits of all Cypriot companies are taxed at the rate of 12.5% (however, effective corporate tax rate is NIL for most international transactions through Cyprus).

Extensive double tax treaty network leading to the avoidance of double taxation.

Profits earned from a permanent establishment abroad are fully exempt from corporation tax (under certain conditions).

Dividend income received in Cyprus from a foreign corporation is wholly exempt from taxes in Cyprus (under certain conditions).

Capital gains are not subject to tax, except on sale of immovable property situated in Cyprus.

Economic Prospects and Opportunities

Cyprus has regained its credibility and reinforced its competitiveness as an attractive investment destination offering numerous opportunities and potential.

The government's commitment to the continuous introduction of progressive measures for reform and growth has resulted in the impressive recovery of the Cypriot economy.

Our Country constitutes today a success story for the EU, a fact enhanced by continuous upgrades from credit rating agencies, such as Standard & Poor's, Fitch and Moody's.

EU and Euro zone Member State

As a member of the European Union since 2004 and the European Monetary Union since 2008, Cyprus is committed quality, efficiency and transparency in transactions.

Safety is amongst the biggest advantages of Cyprus, which has been ranked the safest smaller country in Value Penguin's Safest Countries in the world (2015) and fifth worldwide.

Cyprus offers an enviable lifestyle in a safe, clean and healthy environment with high living standards.

Cyprus has developed a unique culture, a strong Greek character and offers a highly valued safe environment, with low stress levels and very low crime rates, ideal for a peaceful family life. As well is the 1st among smaller Countries in its Safest Countries in the World study for 2015.

Five investment tips for beginners

Starting a new business can be expensive and psychopathic.

The investment plan focuses on removing obstacles to investment, providing visibility and technical assistance to investment projects. there are many tips and tricks you can use to start saving and investing your money so you can open your dream business.

Here are a few to start with:

1. Don't follow the trends, anticipate them

If you have some money to invest, the first thing you need to know is that you shouldn't follow the trends and the crowd.

It's easy to get disoriented from your focus and to lose our original idea.

They often get confused by the false message sent out by the overall market trend and trading pattern. In today's market going up and down, traders should do the due diligence.

You don't want to be one among the crowd, but stay ahead of it.

2. Be cautious

Always be cautious about invest your money in a young business, Caution is key to your success.

A business that sounds good on paper or in the offices could be a flop in reality due poor management. That's not even touching on businesses that are just scams dressed up as legitimate companies. If it sounds too good to be true, it probably is.

3. Investors, don't listen to financial media

If you really want to invest intelligently and constructively, ignore the words you hear from financial media, since many of these facts are meant to distract you towards making expensive mistakes.

Even if you hear something and it turns out to be true, don't get tempted to follow it.

Don't let media and trends nurture your bad investing habits.

4. Spend less than you earn

If you want to build wealth, all you need to do is spend less than what you earn. This sound obvious, but many people don't treat with this philosophy while dealing with their finances. The wider the gap between earning and spending, the more financial success you get.

The important line is to use correct your imagination and to see and focus on the accounting plan that you did.

The formula is composed of two connected ideas:

Earn more: You can increase income through strategies like switching jobs, getting an appraisal or starting a small business.

Spend less: You can reduce your spending through different forms of frugality.

5. Define your investment goal, define your risk

You need to ask yourself: what is the purpose of this investment? And how are you going to follow your first instructions?

The reason this is so important is because it enables you to quantify how much risk you need to take in order to achieve that goal.

You have to understand yours invest, you have to make a correct plan how long time you will be a breakeven point and how the people will understand the products or services that you have.

There are exceptions to every rule, but hope that these few tips are helpful for investors, who have a long-term dreams and goals.

Cyprus Casino announced VIP Casino in the Sky Lounge

The casino resort's hotel will have 500 rooms, and the complex will also feature meeting rooms and space for conferences and other such engagements. This section of the resort will take up around 42,000 square feet, says Spectrum Gaming Capital.

The Luxury resort will also boast a swimming pool, a larger water park, a spa, restaurants, and a beach club.

The multi-million-dollar casino complex in Limassol would include a 70,000-square-floor casino with 1,200 slot machines and 130 table games.

It has also been reported that the complex will feature a 6,000-square-foot Casino in the Sky, which is aimed firmly at bringing in global VIP players.

P.S Spectrum Gaming Capital, New York Financial advisory company has therefore been advising CNS Group since before the bidding began, because Hard Rock International which won the bid for the construction of the casino complex, announced its decision to pull out of their attempts.

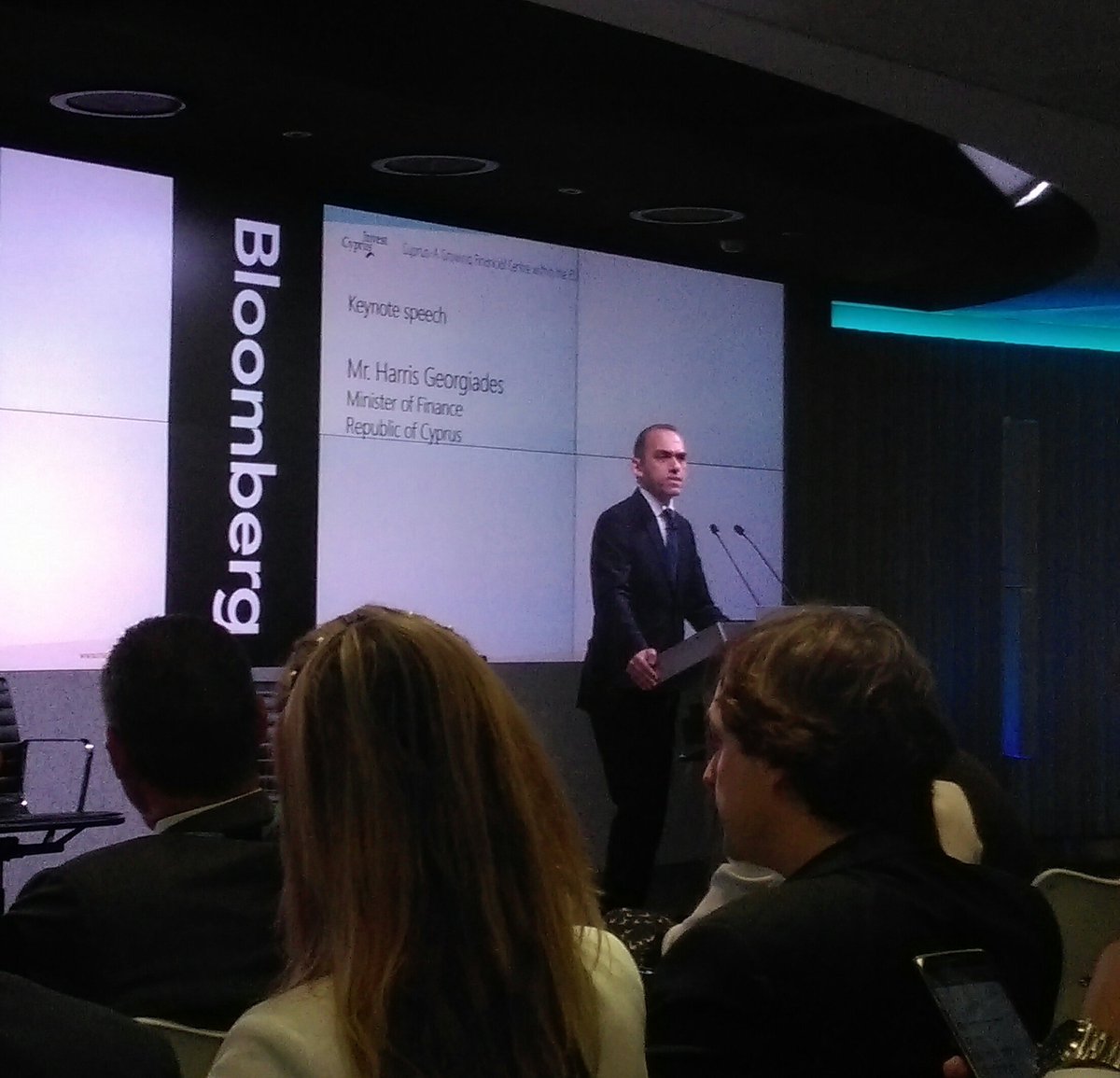

Cyprus: A growing financial center in the EU

CIPA (Cyprus Investment Promotion Agency) and Bloomberg promote Cyprus as a financial centre in London.

The event took place at Bloomberg's headquarters at New York, in the presence of the Cyprus Minister of Finance, Mr. Harris Georgiades.

Investors showed an interest in an event which took place in London by the Cyprus Investment Promotion Agency (CIPA) and international news agency Bloomberg to present Cyprus as a center of investment opportunities, to offer in the financial services, shipping, energy, information technology and innovation sectors.

The most recent positive developments in the banking system were presented during the event, such as the progress that has been observed in the management of non-performing loans and the projections of bank CEOs on the future of the economy, particularly in the field of financial services.

Special reference was made to the measures that have been taken by the Central Bank to ensure a stable regulatory framework.

Showing 41 to 60 of 151 Post

Select Language: